Recently sebi increased the equity derivatives contract from 2 lakhs to 5 lakhshttp://ift.tt/2bjeieF in order to "safeguard the interest of retail investors" and some fellow also started a petition against ithttp://ift.tt/2bjdPsN. Its more than six months and I want to check the effect of this margin increase and how it "safeguarded retail investor".

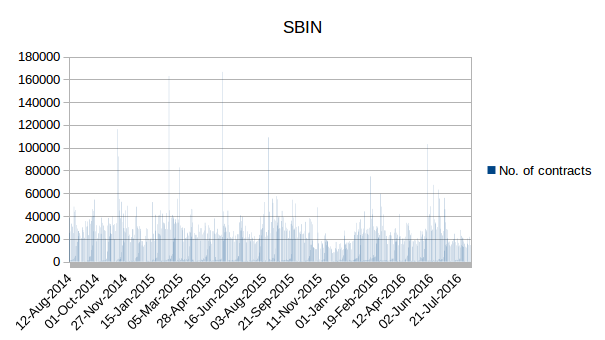

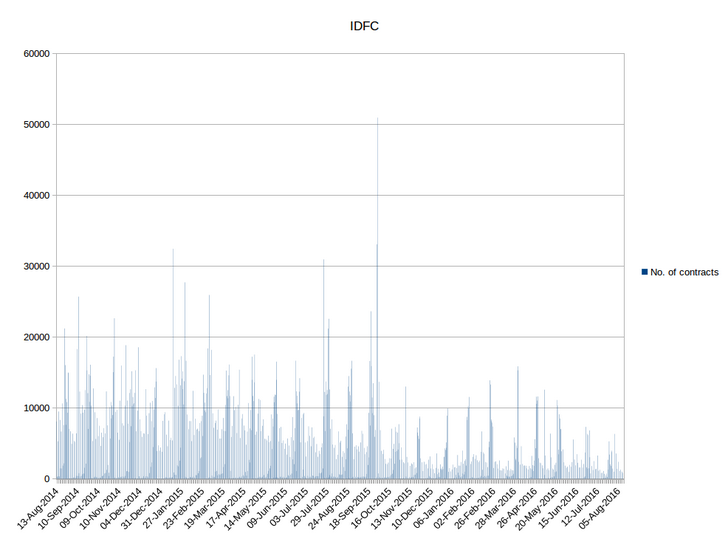

I randomly chose three equtiy futures SBIN, CIPLA and IDFC; then downloaded its historicla data. I plotted two years of equity future contracts No of contracts and Open interest against the Date and this is the result.

SBIN Open interest

SBIN No of contracts

CIPLA Open interest

CIPLA No of contracts

IDFC Open interest

IDFC No of contracts

I am not a statistician so I cant interpret the data properly but the only thing I can see is that there is only a slight decrease in the No of contracts and open interest from sep/oct 2015. The slight decrease is possibly due to the decrease in retail investors.

Conclusion

SEBI safeguarded the rich to become richer :):p

I also welcome your interpretation of the data.

I randomly chose three equtiy futures SBIN, CIPLA and IDFC; then downloaded its historicla data. I plotted two years of equity future contracts No of contracts and Open interest against the Date and this is the result.

SBIN Open interest

SBIN No of contracts

CIPLA Open interest

CIPLA No of contracts

IDFC Open interest

IDFC No of contracts

I am not a statistician so I cant interpret the data properly but the only thing I can see is that there is only a slight decrease in the No of contracts and open interest from sep/oct 2015. The slight decrease is possibly due to the decrease in retail investors.

Conclusion

SEBI safeguarded the rich to become richer :):p

I also welcome your interpretation of the data.

Effect of equity derivative contract size increase on Sep/Oct 2015

Aucun commentaire:

Enregistrer un commentaire